AntPool to refund the overpaid 83 BTC fee of last week

The largest Bitcoin (BTC) mining pool, AntPool, intends to refund the 83 BTC ($3.13 million) overpaid fee. On November 23, an unknown address sent 55 BTC to another unknown address for a cost of 150% of the received amount.

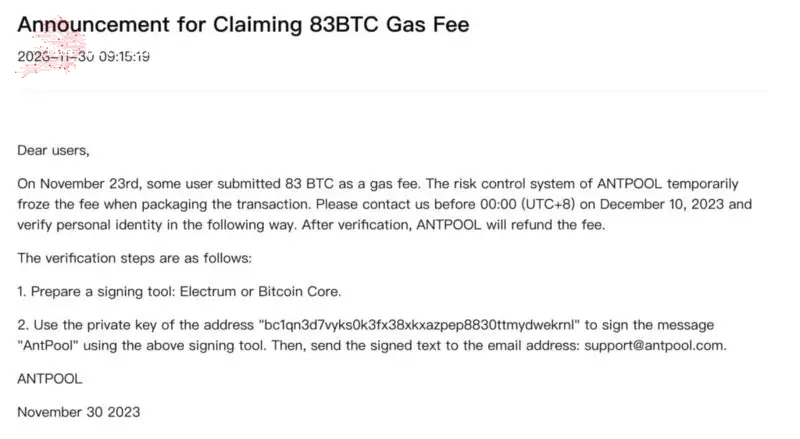

Notably, AntPool announced on November 30 the willingness to refund the owner of the 83 BTC. In the announcement, BITMAIN’s mining pool explained its security system froze the overpaid amount and provided instructions for the refund.

The anonymous entity must use their private key to sign a message from the overpaying address saying “AntPool.” Then, send the signed text to the pool’s support email address in order to retrieve their funds.

As announced, this process must happen until December 10, when the fees will finally be distributed to Antpool’s miners if nobody is able to prove ownership.

AntPool and F2Pool precedents for fee refunding

Previously, F2Pool refunded a 19 BTC fee to Paxos, making this the second fee-refunding event in 2023. Both events create a precedent for Bitcoin transaction fee dynamics and miners’ revenue.

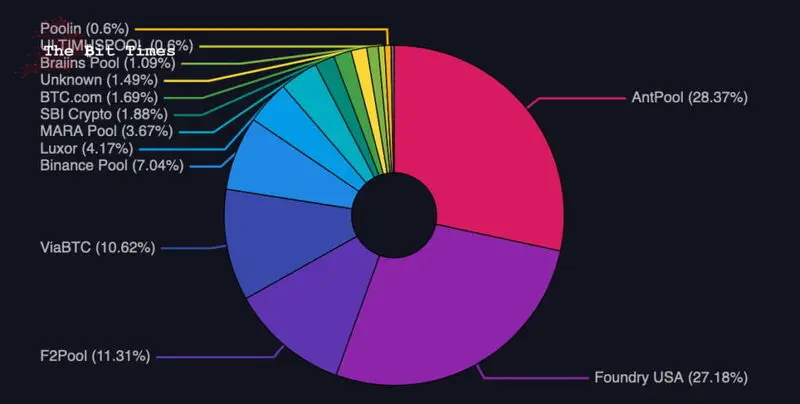

At this point, 40% of Bitcoin’s current hashrate is managed by these two mining pools actively refunding transaction fees. Antpool is responsible for 28.37% and F2Pool for 11.31% of the global BTC block discovery and fee collection.

Meanwhile, F2Pool was also spotted actively filtering OFAC-sanctioned transactions. This event raised criticism, and the former third-largest mining pool lost its position to ViaBTC in the last three days.

Critics point toward a break in the incentives for miners, who were expected to collect their share of these overpaid fees. Interestingly, some speculate that the overpayment was not a mistake and everything was working as intended.

Comments

Post a Comment