What was the most profitable cryptocurrency sector in the first half of 2024?

Author: Biteye Core Contributor Viee

Editor: Biteye Core Contributor Crush

Original link: https://mp.weixin.qq.com/s/uy6y45d9rinmxkoCj7d1EQ

The first half of this year is almost over. Since BTC broke the previous bull market high and rose to 70,000, it has not seen any exciting highs again. In the past few months, the market has fluctuated repeatedly, and the flag set at the beginning of the year to make good money has also slightly wavered. In any case, the main bull market wave has not yet arrived, and there will still be plenty of opportunities, so don’t rush.

At this juncture, it is very suitable to reflect and review. This article is a statistical and comparative analysis of the returns of different cryptocurrency sectors up to 2024. It is no longer the era of “easy money,” so which sector is the most profitable? You’ll know after reading this article.

How have different cryptocurrency sectors performed from the beginning of the year until now?

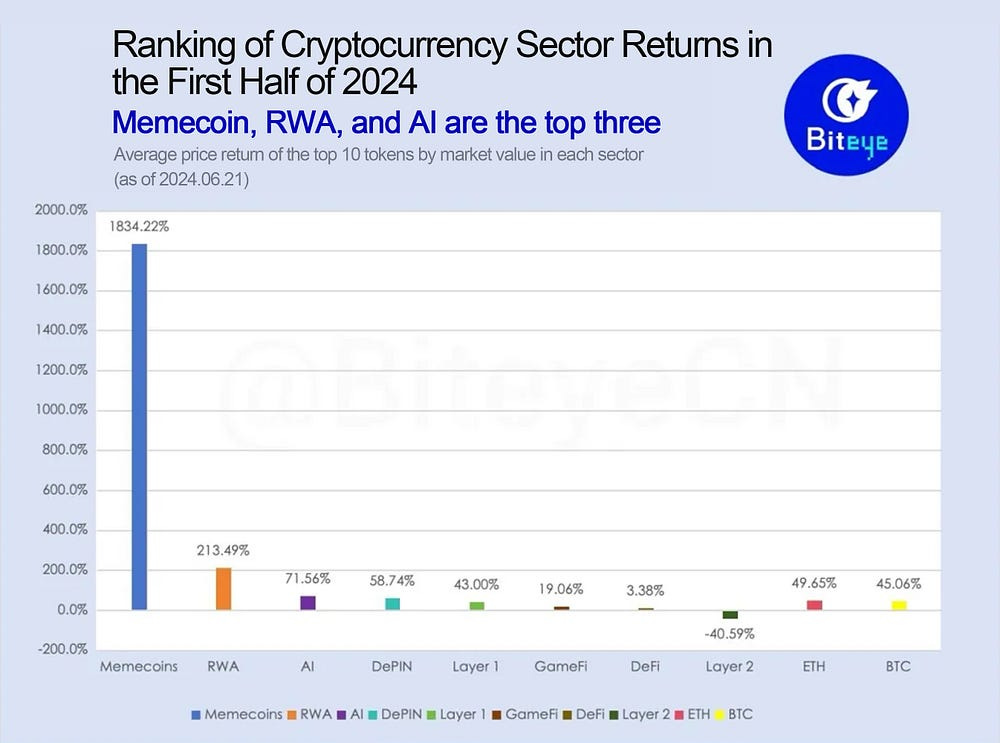

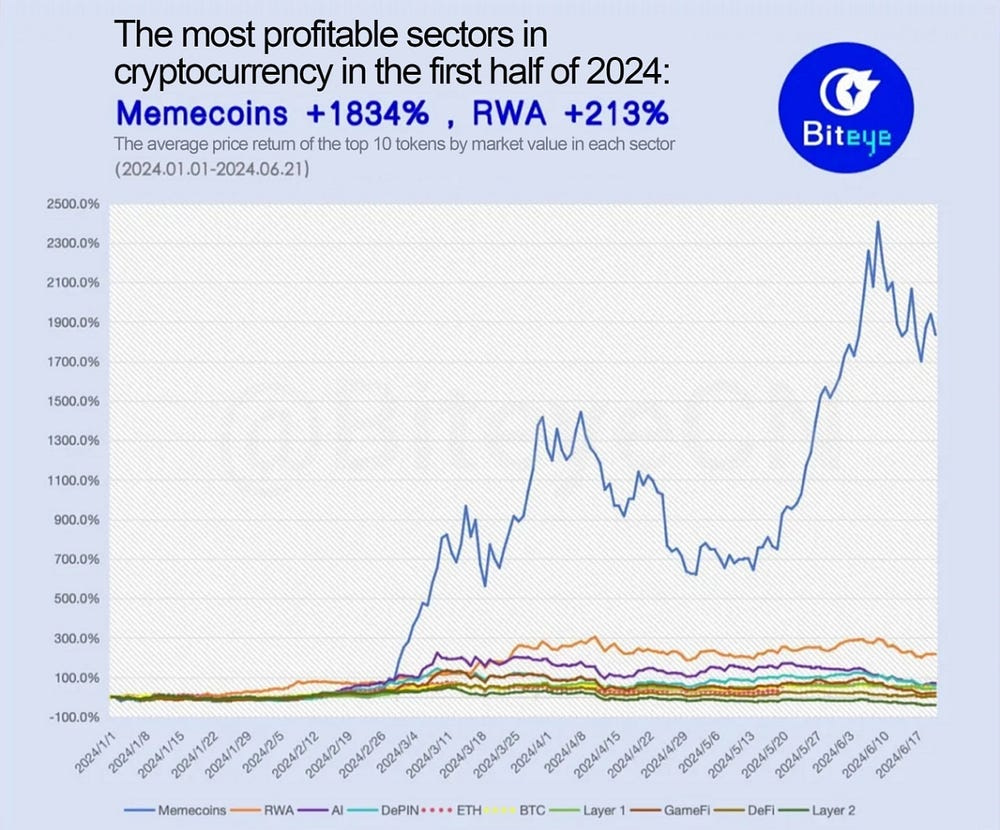

According to the average YTD (January 1, 2024, to June 21, 2024) price return rate of the top 10 tokens in each sector, data from CoinGecko, the performance of cryptocurrency sectors in the first half of 2024 is shown in the chart below.

Meme coins became the most profitable sector

In the past few months, the phrase “value investing is empty, go all-in on MEME to live in the palace” has gradually become one of the mantras of this bull market.

After analysis, there is no doubt that meme coins have been the most profitable sector in 2024 so far, with the highest average return rate reaching 2405.1%. As of June 19, three of the top 10 meme coins by market value were newly launched tokens around March-April: Brett (BRETT), BOOK OF MEME (BOME), and DOG•GO•TO•THE•MOON (DOG).

Among them, BRETT had the highest return rate, rising 14353.54% from its issuance price; dogwifhat (WIF) increased by 933.93% YTD in 2024, sparking the meme coin craze at that time.

It is worth noting that the profitability of meme coins is 8.6 times that of the second most profitable sector, RWA, and 542.5 times that of the least profitable DeFi sector.

(Note: The actual last-ranked Layer 2 sector had negative returns and is not included in the multiple comparisons.)

The second most profitable sector, RWA, has had a return rate of 213.5% so far in 2024.

The concept of RWA (Real World Assets) has been heavily discussed in recent months, with major institutional giants such as BlackRock investing in this sector.

As a result, RWA briefly became the most profitable sector in February, ranking first in return rate, but was later surpassed by Meme coins and the AI sector. It again surpassed the AI narrative at the end of March and performed well in early June.

Among the top RWA tokens by market value, MANTRA (OM) and Ondo (ONDO) had the largest increases, with YTD gains of 1123.8% and 451.12% respectively, while XDC Network (XDC) performed the worst, dropping by 44.38%. Aside from some established DeFi projects, most RWA projects are in their early stages and are worth keeping an eye on.

The AI sector closely follows with a return rate of 71.6%.

As early as the end of 2023, the AI sector frequently appeared in the annual outlooks of various investment institutions. As stated in Messari’s 2024 investment forecast, AI has become the new darling of the tech field. True to expectations, the AI sector has had an average return rate of 71.6% so far in 2024, ranking third.

Among them, Arkham (ARKM) had the highest increase, at 215.50%. Next was AIOZ Network (AIOZ), up 192.19%. Other notable tokens in the first half of the year included Render (RNDR) and Fetch.ai (FET), with return rates of 57.47% and 116.00% respectively, performing well.

DePIN and Layer 1 Achieve Steady Growth

DePIN had mostly negative returns in the first quarter, but since March, it has reversed its decline, reaching a return rate of 58.7% so far.

Among the major market cap DePIN tokens, JasmyCoin (JASMY) performed the best with a gain of 323.42%, followed by Arweave (AR) and Livepeer (LPT), with YTD gains of 174.07% and 116.06%, respectively.

In contrast, Helium (HNT) performed poorly, being the only major market cap DePIN token to drop more than 50%, with a return rate of -50.94%.

DePIN is also one of the sectors capitalized on in this bull market. If the total market cap of DeFi grows 10 times and DePIN’s total market cap reaches half of DeFi’s, DePIN’s total market cap will reach $500 billion, with at least 20 times growth potential.

Layer 1 (L1) sector has had a return rate of 43.0% so far in 2024. Despite Solana (SOL) receiving much attention as the public chain that gave birth to many high-potential memes, its YTD gain is 22.91%, which is a significant drop from its mid-March return rate of 85.05%.

The best-performing major market cap L1 cryptocurrencies are actually Toncoin (TON) and Binance Coin (BNB), with gains of 204.72% and 86.10%, respectively.

In comparison, Bitcoin (BTC), after setting a new high, has a YTD gain of 45.06%, and Ethereum (ETH), despite the high expectations from ETF applications, has a YTD gain of only 49.65%, similar to BTC.

GameFi, DeFi, and Layer 2 Lag Behind

The GameFi sector has a return rate of 19.1%, with relatively little rotation in the market from the beginning of the year until now. Despite considerable financing, no standout hits have emerged.

Among the major market cap GameFi tokens, FLOKI (FLOKI) performed the best with a gain of 362.79%, followed by Ronin (RON) with 21.16%, and Echelon Prime (PRIME) with 5.27% YTD. Other major market cap tokens had negative returns, including GALA (GALA) at -13.43% and Immutable (IMX) at -32.02%.

The DeFi sector performed reasonably well in the first quarter, boosted by the Uniswap (UNI) fee switch proposal at the end of February. However, it lost momentum in the second quarter, with a YTD return rate dropping to 3.4%. Among major market cap DeFi tokens, Maker (MKR) had the highest return rate with a YTD gain of 49.88%.

The Layer 2 (L2) sector performed the worst, with a return rate of -40.59%, nearly halving. Among major market cap L2 tokens, AEVO (AEVO) and Starknet (STRK) performed the worst, with return rates of -85.40% and -63.16%, respectively.

Mainstream Ethereum L2s also performed poorly: Optimism (OP) had a return rate of -54.64% and Arbitrum (ARB) had a return rate of -53.71%. Notably, Mantle (MNT) stood out with a YTD return rate of 26.09%.

Calculation Method

This study, based on data from CoinGecko, analyzed the performance of the most notable cryptocurrency sectors from January 1, 2024, to June 21, 2024, by comparing the average daily price return of the top 10 tokens by market cap in each sector with their prices at the beginning of the quarter. For tokens launched during the quarter, their performance was compared to their initial day price.

Representative tokens in each sector (the top 10 tokens by market cap) were selected based on market cap rankings on the last day of the quarter.

To better meet the objectives of this study, sectors specific to certain chains, sectors with a small number of large market cap tokens, or sectors with high overlap with other sectors were excluded.

This study is for reference only and does not constitute investment advice. Always conduct your own research and exercise caution when investing in any cryptocurrency or financial asset.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Comments

Post a Comment