Bitcoin exchange supply plummets as BTC moves above $100,000

Bitcoin’s (BTC) exchange supply, a measure of how many units of the cryptocurrency are readily available to trade, has steadily been dropping over the past month — with the trend accelerating after BTC crossed the $100,000 mark on May 9.

On May 13, 2.46 million BTC were being held on exchanges, per data retrieved from crypto market intelligence platform CryptoQuant — roughly a month ago, on April 14, exchange supply amounted to 2.56 million Bitcoins — meaning that 3.9% of the BTC held on exchanges has been withdrawn in the course of a month.

When cryptocurrencies are withdrawn from exchanges, the most common destination are private wallets meant for long-term storage. Beyond demonstrating long-term bullishness, this tends to reduce selling pressure.

Shrinking Bitcoin exchange supply and bullish metrics signal that the current BTC slump is temporary

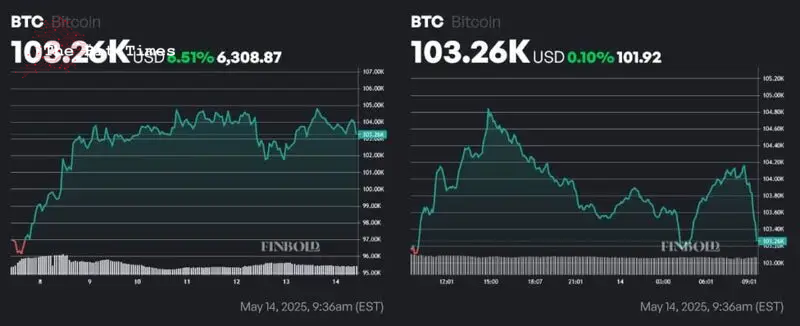

As impressive as Bitcoin’s short-term performance has been, the rally has cooled off significantly. At press time, BTC was changing hands at a price of $103,260, with weekly returns standing at 6.51%. However, in the last 24 hours, the cryptocurrency is only in the green by 0.10% — having marked a 1.5% drop from a daily high of $104,840.

While the prospect of BTC testing support at $100,000 remains a distinct possibility, the wider crypto market’s recovery, as well as positive price action from equities make a drop below support unlikely.

Conversely, several strongly bullish factors are at play. The move above $100,000 caused open interest, a measure of derivatives positions, to reach a 3-month high. Since roughly $20 million in short positions were liquidated between May 13 and May 14 alone, speculative trading is trending toward the bullish side.

Featured image via Shutterstock

Comments

Post a Comment