Dogecoin Must Defend This Level To Avoid A $0.07 Meltdown, On-Chain Data Shows

Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A stark line in the sand has emerged for Dogecoin. Market analyst Ali Martinez (X: @ali_charts) argues that the meme-coin’s near-term trajectory is binary around the $0.18 handle, pairing a channel-based price map with an on-chain URPD readout that concentrates risk directly below. His warning is unambiguous: “Dogecoin fate could hinge on $0.18. If it fails, $0.07 might be next.”

Dogecoin Needs To Bounce Now

Martinez published a one-day chart on November 1 depicting DOGE oscillating inside an ascending channel and presently testing its lower boundary. The chart print shows Binance’s perpetual pair near $0.187 at the time of capture, with a dotted path that either springs from this “buy-the-dip” zone toward the channel’s midline near $0.26 and ultimately the upper rail around $0.33, or, if the support snaps, ejects into a materially lower range.

He summarized the bullish path succinctly in a separate post attached to the same chart: “$0.18 looks like a strong buy-the-dip zone for Dogecoin before a potential run toward $0.26 or $0.33.” Pressed by a user on what had changed, Martinez replied: “Nothing has changed. On both posts everything depends on the $0.18 support level.”

On-Chain Data Confirms Critical Situation

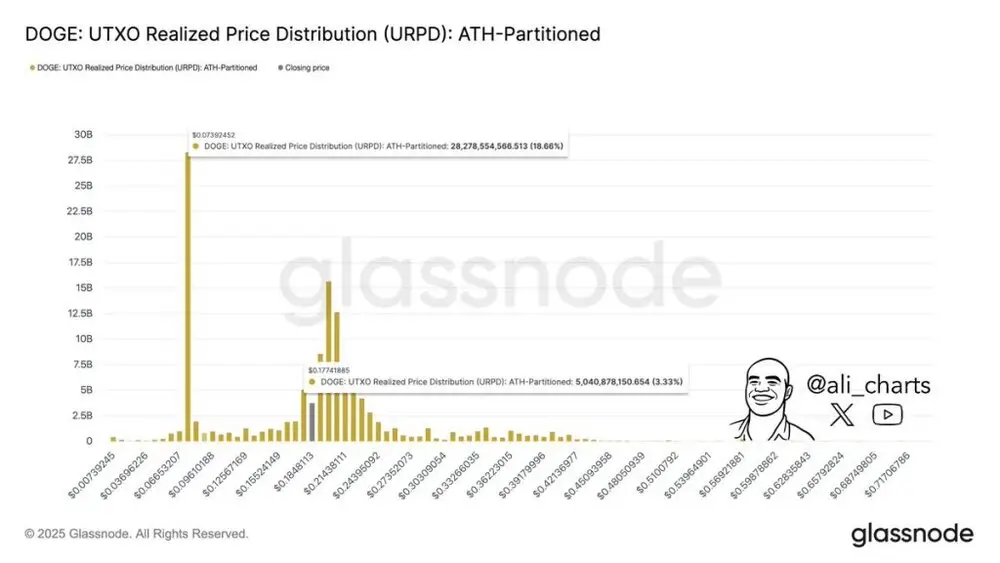

The technical map is reinforced by on-chain positioning. Martinez shared a Glassnode UTXO Realized Price Distribution (URPD) for DOGE partitioned by the all-time-high epoch. URPD bins supply by the last on-chain transaction price, highlighting cost-basis clusters that often function as support and resistance when those cohorts are confronted with drawdowns or break-evens.

The histogram Martinez posted Features a conspicuous bulge around $0.073, labeled at 28,278,554,566.513 DOGE (18.66%), and a secondary local node centered near $0.17741885, labeled at 5,040,878,150.654 DOGE (3.33%). Moreover, the chart exposes a heavy 36+ billion DOGE cluster across $0.18–$0.21 — a critical zone that price has already broken below, adding pressure to the downside.

The implication is straightforward: there is a visible pocket of realized-price liquidity at roughly $0.18 that might catch price on first test; but should that shelf fail, the next dense cohort sits far lower, near seven cents, where nearly a fifth of supply last changed hands.

This pairing of a technical threshold with an on-chain vacuum is what underpins Martinez’s either-or framing. The channel study delineates $0.18 as structural support on the daily timeframe; the URPD shows why the downside air pocket could be deep if sellers force capitulation below that level.

Conversely, a defense of $0.18 would align with his mapped rebound toward the channel’s median near $0.26, with stretch potential to the upper boundary around $0.33 if momentum persists. In Martinez’s words, “everything depends on the $0.18 support level.”

At press time, DOGE traded at $0.173.

Comments

Post a Comment